Multi-Collateral Dai (DAI), a prominent stablecoin in the cryptocurrency market, continues to attract attention from investors and analysts. This article provides a detailed analysis of the short, medium, and long-term price predictions for DAI from 2024 to 2030.

Short-Term Price Predictions

5-Day Prediction

The price of Multi-Collateral Dai is expected to reach $1.026 by December 19, 2023, reflecting a 2.66% increase from its current value of $0.999.

1-Month Prediction

By January 13, 2024, DAI is predicted to rise to $1.014, marking a 1.48% increase.

Medium-Term Price Predictions

2024 Prediction

The price forecast for 2024 suggests a trading range between $0.934 and $1.065. The expected price increase of up to 6.49% indicates a stable appreciation.

2025 Prediction

For 2025, the price range is predicted to be between $0.935 and $1.068. The potential 6.83% increase indicates a stable outlook for DAI.

| Year | Lower Range ($) | Upper Range ($) | Potential Gain (%) |

|---|---|---|---|

| 2024 | 0.934574 | 1.064613 | 6.49 |

| 2025 | 0.934574 | 1.067991 | 6.83 |

Long-Term Price Predictions

2026–2030 Predictions

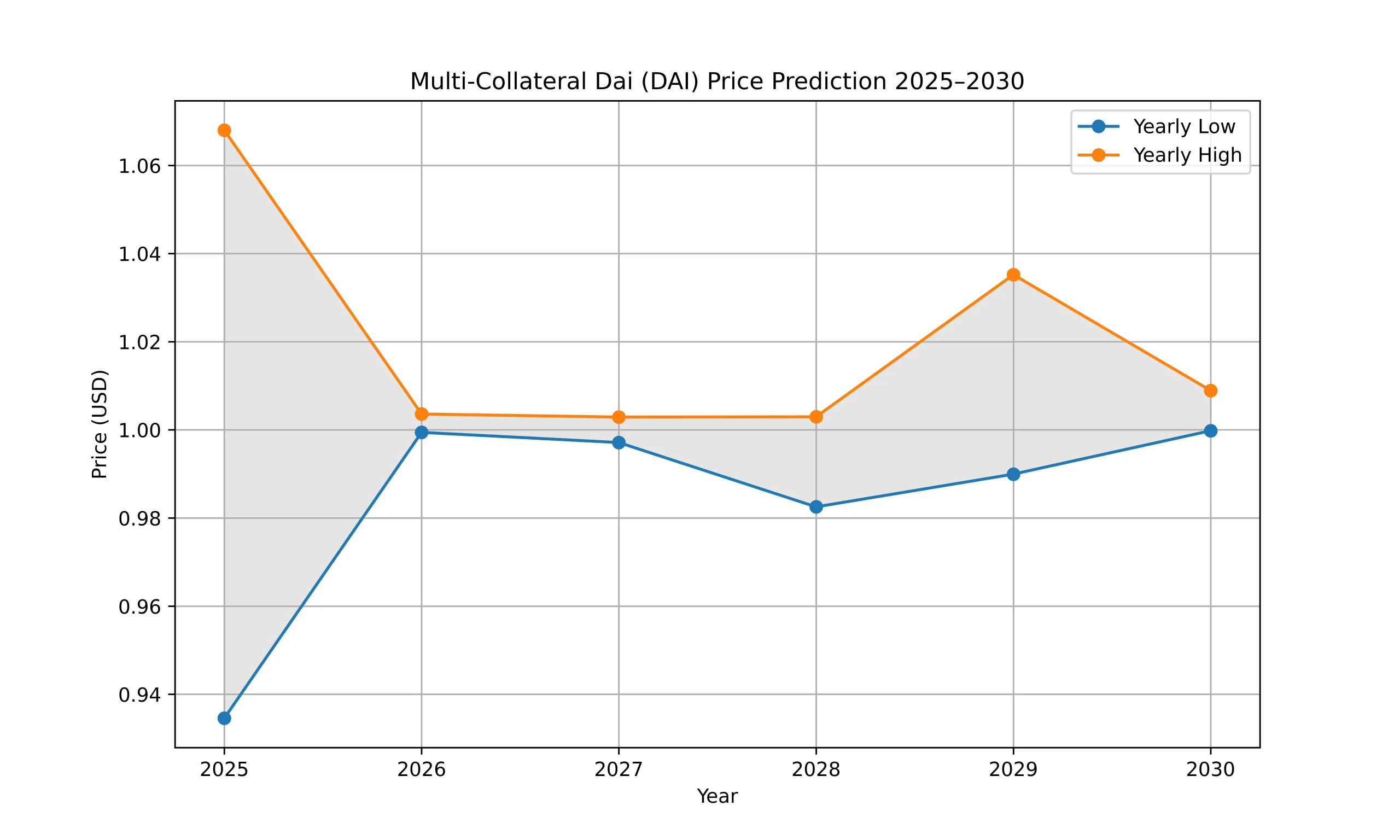

The long-term outlook for Multi-Collateral Dai remains relatively stable with slight fluctuations.

- 2026: $0.999 to $1.004

- 2027: $0.997 to $1.003

- 2028: $0.983 to $1.003

- 2029: $0.990 to $1.035

- 2030: $0.999 to $1.009

| Year | Lower Range ($) | Upper Range ($) | Potential Gain (%) |

|---|---|---|---|

| 2026 | 0.999427 | 1.003590 | 0.41 |

| 2027 | 0.997119 | 1.002901 | 0.58 |

| 2028 | 0.982525 | 1.002969 | 0.55 |

| 2029 | 0.989957 | 1.035213 | 4.56 |

| 2030 | 0.999805 | 1.008912 | 0.92 |

Technical Analysis and Market Sentiment

Current Price and Sentiment

- Current Price: $0.999

- Predicted 1-Month Price: $1.014 (+1.48%)

- Fear & Greed Index: 72 (Greed)

- Sentiment: Neutral

- Volatility: 0.10%

Technical Indicators

- 50-Day SMA: $0.999

- 200-Day SMA: $1.000

- 14-Day RSI: 51.91 (Neutral)

- Support Levels: $0.998, $0.997, $0.996

- Resistance Levels: $1.000, $1.001, $1.002

Moving Averages and Oscillators

The simple and exponential moving averages, along with other oscillators, indicate a neutral to slightly bearish trend in the short term, with most indicators suggesting either a hold or sell position.

Historical Performance and Correlations

Over the past year, Multi-Collateral Dai has shown minimal price fluctuation, typical of a stablecoin:

| Period | Change (%) |

|---|---|

| 1 Year | -0.06 |

| 3 Years | -0.57 |

| 5 Years | +8.48 |

DAI has exhibited positive correlations with other top cryptocurrencies like OKB, Cardano, and TRON while showing negative correlations with Maker, IOTA, and NEM.

Conclusion

Multi-Collateral Dai is expected to maintain its stability with slight appreciation over the next few years. While its primary function as a stablecoin limits significant price growth, it remains a reliable asset for investors seeking stability. The price predictions suggest modest gains, and the current market sentiment supports a cautious but optimistic outlook for DAI.

Read: SolarX (SXCH) Price Prediction

[…] Read: Multi-Collateral Dai (DAI) Price Prediction […]