Recently, many SoFi users got a strange email saying their federal student loan data was no longer syncing with Plaid. The email asked them to update their information because of changes in Plaid’s data services.

This alarmed many people, especially those who never had a federal student loan or even a SoFi account.

People quickly started questioning whether this email was real or a scam. Since financial data is sensitive, users were right to be cautious.

The good news is that SoFi later confirmed the email was not a scam but a system error. Still, the email had some red flags that made it look suspicious.

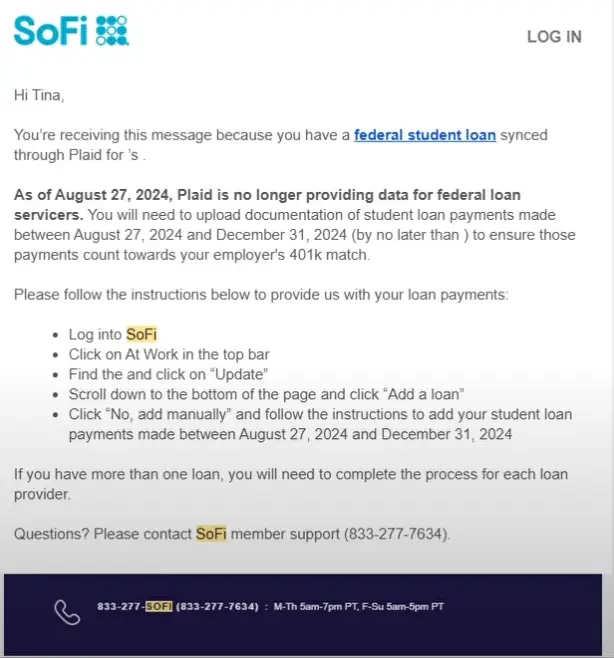

What Was in the SoFi Email?

The email came from “no-reply@atos.so.org” and said users had to manually upload proof of student loan payments due to changes in Plaid’s data services.

Many found this odd, especially those who never had a federal student loan. The email also provided a support number for questions.

After investigating, SoFi confirmed it was a system error, not a phishing attempt. Some users got the email by mistake, even if they never had a student loan.

SoFi advised them to ignore it and assured them that there was no security breach or unauthorized activity.

Despite SoFi’s confirmation, some details still seemed off. The email did not address recipients by name, making it look like a generic scam.

The sender’s domain, “atos.so.org,” also seemed unusual compared to SoFi’s official website, “sofi.com.”

However, checking further showed that “so.org” redirected to SoFi’s website, proving the email came from them.

This mistake may have been caused by a system glitch or outdated user data. Some former users might have received the email because their information was still stored in SoFi’s system.

This situation is a reminder to be careful with emails asking for financial updates. Even though this one was a mistake, it had signs of a phishing scam, which is why people were skeptical.

Our Opinion

SoFi admitted the email was an error, but it still caused panic. Financial scams are everywhere, and people have good reason to be wary of emails asking for account updates, especially when they never took out a loan.

The email looked suspicious because of its unusual sender address, lack of personal details, and request for sensitive financial information.

SoFi’s follow-up statement helped ease concerns, but this incident shows why verifying emails is important.

Some users shared their experiences online, with some saying they got follow-up emails confirming the mistake, while others said they never heard anything from SoFi.

This lack of communication only added to the confusion.

Another issue was the phone number in the email. Some users said it didn’t match SoFi’s official support number. While SoFi confirmed the email was real, the incorrect number raised more questions.

Even legitimate emails can have errors, so it’s always best to double-check information through official channels.

This situation is a good reminder that scams often look like real emails from financial institutions.

Even if an email seems legit, always double-check by logging into your account directly or calling customer support from the official website.

Financial companies also need to be more careful to avoid these mistakes, as even a small error can cause panic and break customer trust.

What to Do If You Get Scammed?

If you ever get a suspicious email asking for personal information, take immediate action. Do not click on any links, as they could lead to fake websites trying to steal your information.

Instead, type the company’s official website into your browser and check your account for alerts.

Always verify the sender’s email address and compare it with the company’s official domain. If you’re unsure, contact customer support using the phone number on their official website, not the one in the email.

Scammers often include fake support numbers to trick people.

If you accidentally clicked a suspicious link or shared your details, change your passwords right away and monitor your financial accounts for any strange activity.

Turning on two-factor authentication (2FA) adds extra security.

If you confirm a scam, report it to the Federal Trade Commission (FTC) or your bank’s fraud department. Reporting helps stop fraud and protects others from falling for the same scam.

Glyco Sync Blood Support is a supplement designed to help control blood sugar and improve circulation.